We aim to make the process of finding finance as simple as possible.

We can offer you financing options from a diverse array of funders from throughout the whole of the market as we are not tied or limited to whom we can work with.

The ability to access so many lenders, means that you are always being offered the best possible options with us and all of our deals are tailored to your specific requirements.

The size of your business or indeed what sector you operate in is not a barrier as we work closely with you – from start to finish – to find solution to fit your circumstances and requirements.

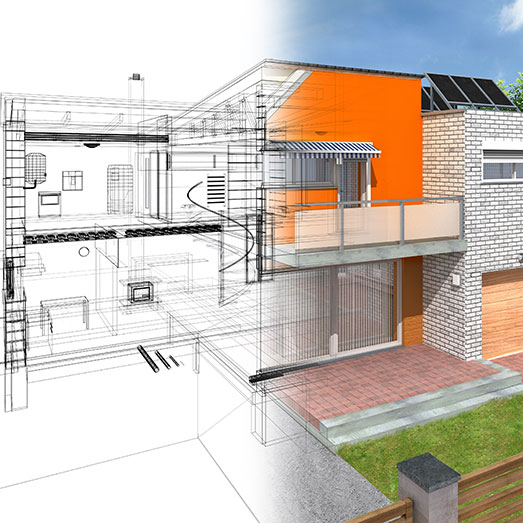

Property finance funding options.

Learn more about each of property development funding options we can offer, including:

- Commercial Property Mortgages

- Residential Development Financing

- Commercial Investment Mortgages

To speak to a member of the Simple CF team in more detail about our property funding solutions, call 01964 545965, email info@simplecf.com or complete our enquiry form.